Environmental, social and governance monitoring will get simpler with ESGgo – TechCrunch

You may swing an ethically sourced, domestically produced, sustainably raised useless fish lately without hitting a set of Environmental, Social, and Governance (ESG) objectives in an organization’s board conferences or annual studies. Stunning, then, that whereas it’s straightforward to get the PR for having the objectives, it’s approach tougher to truly measure and observe how firms are performing in opposition to these objectives. Bored with scorching air and empty guarantees — and desirous to make it simpler to truly implement the objectives which can be set, ESGgo comes alongside. The corporate creates a software program suite to assist change that — and it simply raised $7 million to strap on some trainers and get moving into earnest.

“The goal prospects are firms — or mainly any firm that already is public or is contemplating turning into public,” explains Orly Glick, CEO, and co-founder at ESGgo.

The product itself is concentrated on information assortment; from the primary 50 firms ESGgo spoke to, they realized that there have been no instruments obtainable. The corporate realized that almost all ESG monitoring is presently carried out in some fairly esoteric techniques — largely spreadsheets or collaborative databases. Exterior ranking businesses could have their very own instruments, in fact, however, for inside use, it’s slim pickings.

“Proper now, ESG is seen by some as all discuss, little motion — there could also be a whole bunch of executives touting the significance of ESG, however, we nonetheless lack a common measuring stick for clearly understanding ESG efficiency,” Bruce Dahlgren wrote as a part of a TechCrunch+ article earlier this 12 months. “Without that, it’s troublesome to find out what is correct from what's unsuitable, or what's a robust funding from a shortsighted one.”

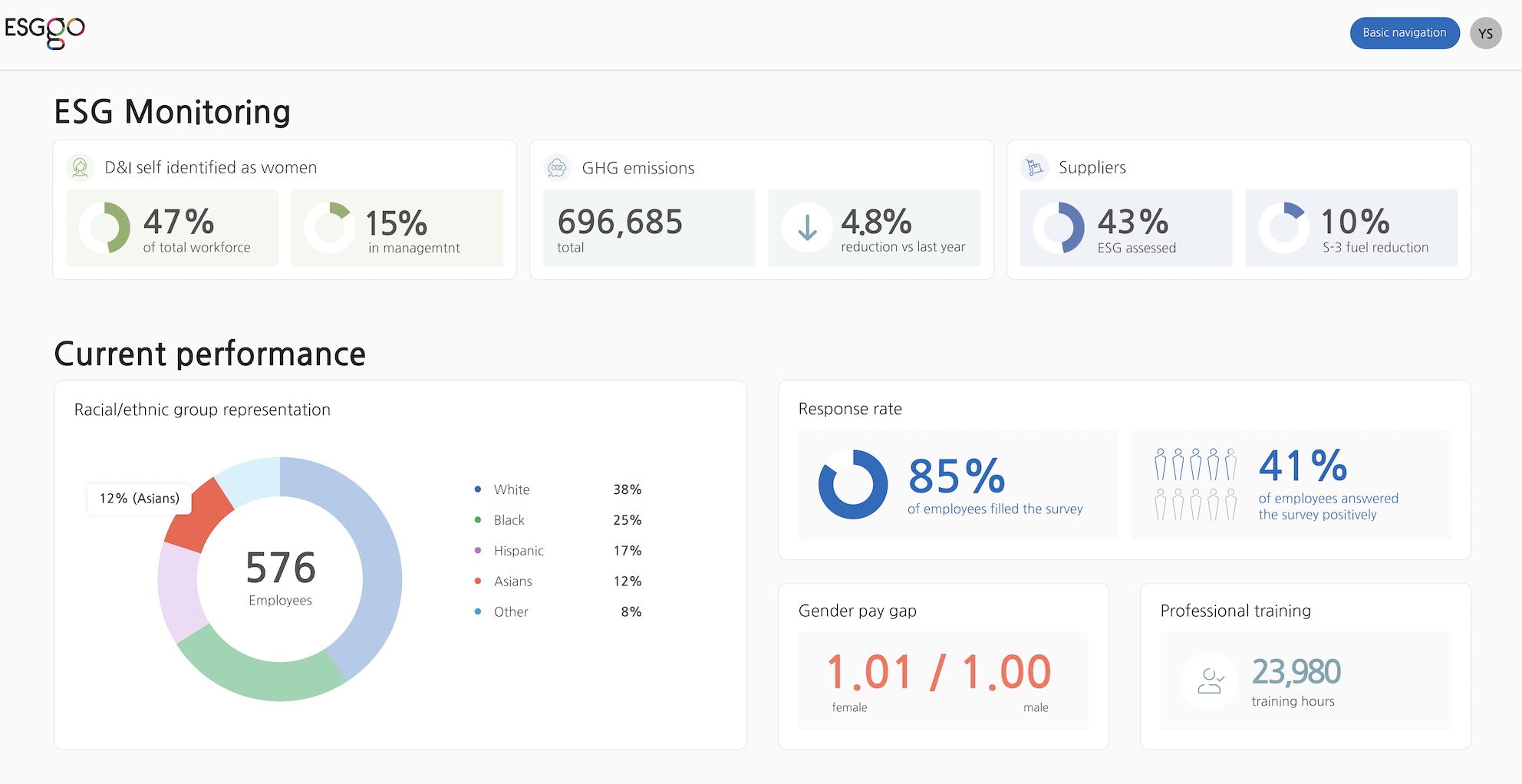

To totally observe ESG's impression throughout an enterprise, the GRI and SASB requirements recommend monitoring a whole bunch of knowledge factors throughout the group. Information assortment, then, is especially necessary, in addition to gathering data from numerous information sources, earlier than collating, analyzing, and reporting on it. This information, mixed with measuring it in opposition to the corporate’s objectives, is the area the place ESGgo operates.

“Even on the human aspect of knowledge assortment — it’s simply not enjoyable to must go knocking on folks’ doorways throughout departments to begin asking for data. So along with the info itself, our software does workflow administration. Lastly, we do the analytics of all the info, and we see the present scenario of the corporate of their ESG, versus historic efficiency. Hole evaluation and benchmarking versus the trade to see how we can turn into higher versus your friends and opponents. The latter, specifically, will probably be an AI optimization.”

The corporate raised $7 million led by Israeli enterprise agency Glilot Capital at an undisclosed valuation.

“Glilot just isn't solely one of many high funds in Israel, however, they're a superb, world fund. They've operational expertise, rigorous operational expertise, and they're actual mensches. They promote girls and have an outstanding value-creation staff,” says Glick. “We even have some actually very attention-grabbing angel traders from the Valley and a number of the high tech firms within the Valley that basically consider in local weather.”

Glick leads a staff of 10 or so, throughout Israel and California. She co-founded the corporate with Ido Inexperienced, who lower his enamel on senior-level engineering roles at Google, Netflix, and, most lately Fb.

“We’re thrilled to be an early supporter of ESGgo. Orly has an unimaginable observe file and is sensible imaginative and prescient for utilizing know-how to enhance ESG reporting. With sustainability and social duty considerations altering the best way companies and traders consider danger and alternative, it’s the proper time for this disruptive resolution,” stated Kobi Samboursky, co-founder and managing companion of Glilot Capital. “Serving to firms enhance their ESG posture is extra necessary than ever, and Orly is the proper particular person to make the change wanted.”

The seed funding will enable ESGgo to speed up its recruiting, beginning with Israel-based engineering staff, and additionally develop its product providing.

Post a Comment

0 Comments