Which Is the Best Mobile Payment And Wallet App 2022

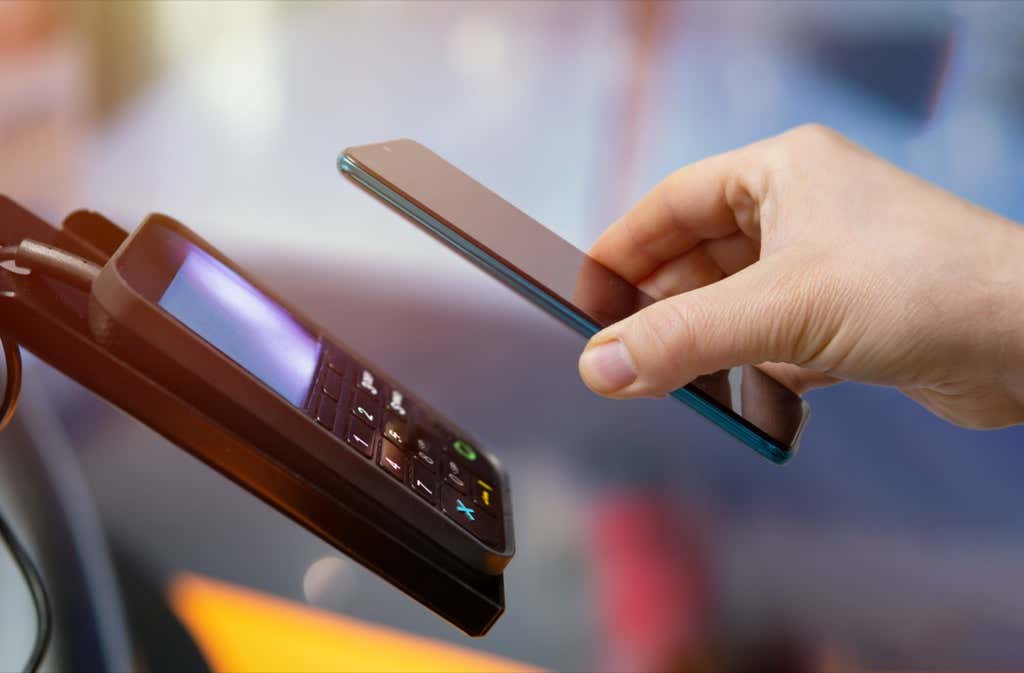

Contactless fee apps supply a secure, handy strategy to pay by smartphone. For non-iPhone customers, there are two main gamers on this area—Samsung Pay and Google Pay.

On this article, we’ll listing the options of and variations between Samsung Pay and Google Pay and describe which cell fee app is most price utilizing.

What Is Google Pay?

Google Pay, previously often called Android Pay, is a cell fee app that you should utilize to make purchases, in addition to ship and obtain cash. To make use of it, all you need to do is unlock the cellphone and faucet it in opposition to the contactless fee terminal.

Listed here are the options for Google Pay:

- Huge availability. Google Pay is accessible in 42 international locations which is second solely to Apple Pay.

- Peer-to-peer funds. Simply ship and obtain cash out of your family and friends with Google Pay Ship. All you want is an electronic mail deal with. Nevertheless, P2P does include added charges, and the service is presently solely obtainable within the US.

- Huge help for credit score and debit playing cards. Google Pay helps most main bank cards and fee providers, together with American Specific, Uncover, MasterCard, Visa, and AMEX. It additionally helps most main banks – test the listing on Google’s help web page. Google Pay additionally makes it potential to pay through PayPal.

- Google Pockets shops your passes and playing cards. Google Pay means that you can retailer loyalty, membership, and reward playing cards, in addition to journey passes, tickets, and account playing cards in a single place.

- Assist for Put on OS smartwatches. You may set up and use the Google Pay app through your Put on OS smartwatch. It simply wants NFC (Close to Discipline Communication) capabilities.

- Google Pay provides. You may opt-in to Google Pay rewards and obtain unique provides, collectibles, promo codes, and many others.

- Added safety. Google Pay makes use of industry-standard tokenization and NFC know-how to ship encrypted knowledge to retailers, making it safer than conventional bank cards. The app additionally permits fingerprint scanning or facial recognition entry, and there are limits to the quantity that may be bought or despatched through the app.

The place Google Pay Falls Brief

Google Pay is full of options, and for many customers, it's a completely appropriate app. Nevertheless, it has some shortcomings, together with:

- Restricted options exterior of the US. P2P help is simply obtainable for customers inside the US, which is unhealthy information for worldwide customers.

- Cluttered UI. The revamped Google Pay app has obtained substantial criticism for its complicated structure. Making funds is straightforward sufficient, however sorting by means of the playing cards in your digital pockets will be troublesome.

- Google Pay shouldn't be all the time accepted. Although most shops now help Google Pay purchases, some don't. You continue to want to hold around a secondary fee methodology, which for some individuals, removes your complete level of getting a contactless fee app in the first place.

What Is Samsung Pay?

Samsung Pay is a handy one-tap contactless fee and digital pockets app obtainable to Samsung cellphone homeowners. A easy swipe up from the lock display opens your fee choices, permitting you to pay immediately.

Lately, Samsung Pay has overtaken Google pay because the second-largest cell fee app (behind Apple Pay, the most well-liked app).

Options of Samsung Pay:

- Availability in 29 international locations. Whereas that is fewer international locations than Google Pay helps, the listing is continually rising.

- Assist with much main credit score and debit playing cards. Samsung Pay helps most main fee platforms, together with all main bank card firms. The full listing is on their help website. Samsung Pay additionally provides help for PayPal funds.

- Samsung Rewards. With Samsung Rewards, you'll be able to earn factors for every buy you make whereas utilizing the app. These factors will be redeemed to make purchases utilizing the Samsung app (or on the Samsung website).

- Cell pockets for playing cards and passes. Retailer and use reward playing cards, membership playing cards, and loyalty playing cards with the app by scanning the cardboard’s barcode. Samsung Pay additionally means that you can create a digital pockets, together with making a verified Vaccine Cross out of your vaccination paperwork.

- Appropriate with Samsung smartwatches. Some Samsung Galaxy wearables help Samsung Pay, together with the Gear S3, Galaxy Watch3, and Galaxy Watch Active2.

- Helps each NFC and MST (Magnetic Safe Transmission). MST know-how permits your Android cellphone to speak with older magnetic stripe card readers that require you to swipe a card. Nevertheless, help for MST is being eliminated as of the Galaxy S21.

- Added safety. Your Samsung Pay particulars are protected by Samsung Knox and tokenization. Like Google Pay, your card data isn’t despatched to retailers. Additionally, Samsung Pay means that you can use Discover My Cell to remotely lock your account or take away the app from your cell phone. The app additionally helps with fingerprint and facial recognition authentication.

The place Samsung Pay Wants Enchancment

Whereas Samsung Pay meets the most important necessities of a contactless tap-as-you-go fee app, it has three important drawbacks in performance.

- Restricted appropriate smartphones. Samsung Pay is simply obtainable on Samsung smartphones and doesn't work on different Android fashions. In case you determine to purchase a non-Samsung gadget, you’ll should arrange Google Pay (or one other various) as Samsung Pay received’t be obtainable. Regardless of this limitation, Samsung Pay has extra lively customers than Google Pay.

- An annoying variety of adverts and pop-ups. A typical frustration for Samsung customers is the gradual introduction of adverts into the native Samsung apps, which holds true for Samsung Pay. Many customers complain that intrusive adverts even pop up throughout the fee course of.

- Removing MST help. Whereas increasingly locations are getting on board with NFC terminals, many nonetheless use MST. The final Samsung fashions to help MST funds had been the Samsung Notice 20 sequence. Sadly, this was the principle cause many customers determined to make use of Samsung over Google.

Samsung Pay vs. Google Pay: Which is Higher?

Samsung Pay and Google Pay are comparable by way of the service they supply and fee strategies they help (together with on-line funds). Nonetheless, Google Pay helps extra units and is accessible in additional international locations.

The primary cause to decide on Samsung Pay is that if your space nonetheless primarily makes use of MST terminals. In that case, you received’t run into the difficulty of being unable to pay with Google Pay. Nevertheless, with NFC know-how gaining popularity (and Samsung withdrawing help for this), it isn’t a deciding issue.

Google Pay provides peer-to-peer funds within the US, which will be useful in lots of conditions and helps to chop down on the variety of apps you want. That is potential with Samsung, however you should sign-up for Samsung Pay Money as effectively.

One other main cause to decide on both apps is the opposite equipment you personal. For instance, in case you have a Samsung smartwatch, you’re higher off going with Samsung Pay.

Contactless fee apps supply a secure, handy strategy to pay by smartphone. For non-iPhone customers, there are two main gamers in this area—Samsung Pay and Google Pay.

On this article, we’ll listing the options of and variations between Samsung Pay and Google Pay and describe which cell fee app is most price utilizing.

What Is Google Pay?

Google Pay, previously often called Android Pay, is a cell fee app that you should utilize to make purchases, in addition to ship and obtain cash. To make use of it, all you need to do is unlock the cellphone and faucet it in opposition to the contactless fee terminal.

Listed here are the options for Google Pay:

- Huge availability. Google Pay is accessible in 42 international locations which is second solely to Apple Pay.

- Peer-to-peer funds. Simply ship and obtain cash out of your family and friends with Google Pay Ship. All you want is an electronic mail deal. Nevertheless, P2P does include added charges, and the service is presently solely obtainable within the US.

- Huge help for credit score and debit playing cards. Google Pay helps most main bank cards and fee providers, together with American Specific, Uncover, MasterCard, Visa, and AMEX. It additionally helps most main banks – test the listing on Google’s help web page. Google Pay additionally makes it potential to pay through PayPal.

- Google Pockets shops your passes and playing cards. Google Pay means that you can retailer loyalty, membership, and reward playing cards, in addition to journey passes, tickets, and account playing cards in a single place.

- Assist for Put on OS smartwatches. You may set up and use the Google Pay app through your Put on OS smartwatch. It simply wants NFC (Close to Discipline Communication) capabilities.

- Google Pay provides. You may opt-in to Google Pay rewards and obtain unique provides collectibles, promo codes, and many others.

- Added safety. Google Pay makes use of industry-standard tokenization and NFC know-how to ship encrypted knowledge to retailers, making it safer than conventional bank cards. The app additionally permits fingerprint scanning or facial recognition entry, and there are limits to the quantity that may be bought or despatched through the app.

The place Google Pay Falls Brief

Google Pay is full of options, and for many customers, it's a completely appropriate app. Nevertheless, it has some shortcomings, together with:

- Restricted options exterior of the US. P2P help is simply obtainable for customers inside the US, which is unhealthy information for worldwide customers.

- Cluttered UI. The revamped Google Pay app has obtained substantial criticism for its complicated structure. Making funds is straightforward sufficient, however, sorting using the playing cards in your digital pockets will be troublesome.

- Google Pay shouldn't be all the time accepted. Although most shops now help Google Pay purchases, some don't. You continue to want to hold round a secondary fee methodology, which for some individuals, removes your complete level of getting a contactless fee app within the first place.

What Is Samsung Pay?

Samsung Pay is a handy one-tap contactless fee and digital pockets app obtainable to Samsung cellphone homeowners. An easy swipe up from the lock display opens your fee choices, permitting you to pay immediately.

Lately, Samsung Pay has overtaken Google pay because the second-largest cell fee app (behind Apple Pay, the most well-liked app).

Options of Samsung Pay:

- Availability in 29 international locations. Whereas that is fewer international locations than Google Pay helps, the listing is continually rising.

- Assist with many many credit scores and debit playing cards. Samsung Pay helps most main fee platforms, together with all main bank card firms. The full listing is on their help web site. Samsung Pay additionally provides help for PayPal funds.

- Samsung Rewards. With Samsung Rewards, you'll be able to earn factors for every buy you make whereas utilizing the app. These factors will be redeemed to make purchases utilizing the Samsung app (or on the Samsung web site).

- Cell pockets for playing cards and passes. Retailers use reward playing cards, membership playing cards, and loyalty playing cards with the app by scanning the cardboard’s barcode. Samsung Pay additionally means that you can create a digital pockets, together with making a verified Vaccine Cross out of your vaccination paperwork.

- Appropriate with Samsung smartwatches. Some Samsung Galaxy wearables help Samsung Pay, together with the Gear S3, Galaxy Watch3, and Galaxy Watch Active2.

- Helps each NFC and MST (Magnetic Safe Transmission). MST know-how permits your Android cellphone to speak with older magnetic stripe card readers that require you to swipe a card. Nevertheless, help for MST is being eliminated as of the Galaxy S21.

- Added safety. Your Samsung Pay particulars are protected by Samsung Knox and tokenization. Like Google Pay, your card data isn’t despatched to retailers. Additional, Samsung Pay means that you can use Discover My Cell to remotely lock your account or take away the app out of your cell phone. The app additionally helps with fingerprint and facial recognition authentication.

The place Samsung Pay Wants Enchancment

Whereas Samsung Pay meets the most important necessities of a contactless tap-as-you-go fee app, it has three important drawbacks in performance.

- Restricted appropriate smartphones. Samsung Pay is simply obtainable on Samsung smartphones and doesn't work on different Android fashions. In case you determine to purchase a non-Samsung gadget, you’ll should arrange Google Pay (or one other various) as Samsung Pay received’t be obtainable. Regardless of this limitation, Samsung Pay has extra lively customers than Google Pay.

- An annoying variety of adverts and pop-ups. A typical frustration for Samsung customers is the gradual introduction of adverts into the native Samsung apps, which holds true for Samsung Pay. Many customers complain that intrusive adverts even pop up throughout the free course.

- Removing MST help. Whereas increasingly locations are getting on board with NFC terminals, many nonetheless use MST. The final Samsung fashions to help MST funds had been the Samsung Notice 20 sequence. Sadly, this was the principle cause many customers determined to make use of Samsung over Google.

Samsung Pay vs. Google Pay: Which is Higher?

Samsung Pay and Google Pay are comparable by way of the service they supply and fee strategies they help (together with on-line funds). Nonetheless, Google Pay helps extra units and is accessible in additional international locations.

The primary cause to decide on Samsung Pay is that if your space nonetheless primarily makes use of MST terminals. In that case, you received’t run into the difficulty of being unable to pay with Google Pay. Nevertheless, with NFC know-how gaining popularity (and Samsung withdrawing help for this), it isn’t a deciding issue.

Google Pay provides peer-to-peer funds within the US, which will be useful in lots of conditions and helps to chop down on the variety of apps you want. That is potential with Samsung, however you should sign-up for Samsung Pay Money as effectively.

One other main cause to decide on both apps is the opposite equipment you personal. For instance, in case you have a Samsung smartwatch, you’re higher off going with Samsung Pay.

Post a Comment

0 Comments